Creating a joyful rewards experience for Cheese banking app

FROM 0 ➞ 1

OVERVIEW

Traditional banks charge all kinds of account fees. For people like new immigrants in the US who aren’t qualified for applying for credit cards, they can’t enjoy cash back rewards. Cheese mobile banking, founded in 2019, aimed to address this by providing a zero-fee debit card that offers cash back rewards.

Background

In 2020, during my 4-month contract as a product designer at Cheese, I led a cross-functional design sprint to brainstorm an engaging cash back rewards experience. Collaborating with Product, Software Development, Growth and Marketing teams, we developed creative ideas to boost user growth and engagement.

Project Summary

New immigrants in the US need a bank account.

USER NEED

Pain Point #1

No credit history

Pain Point #2

Not eligible for credit cards

Pain Point #3

Can’t earn cash back rewards

Cheese offers ––––

A debit card with cash back rewards.

How to help users earn cash back in a joyful and engaging way?

DESIGN CHALLENGE

Inspired by the Design Sprint method developed at Google Ventures, I coordinated a company-wide design sprint to brainstrom and crafted design solutions in a week.

THE SOLUTION

Tap to reveal a high-value cashback offer, optimized for user delight.

How did I get to the solution?

How did I get to the solution?

Design Sprint Preview

Context Gathering

Day 1

Ideation

Day 2

Demo & Vote

Day 3

Design & Prototype

Day 4

Test

Day 5

DESIGN SPRINT DAY 1

Context Gathering

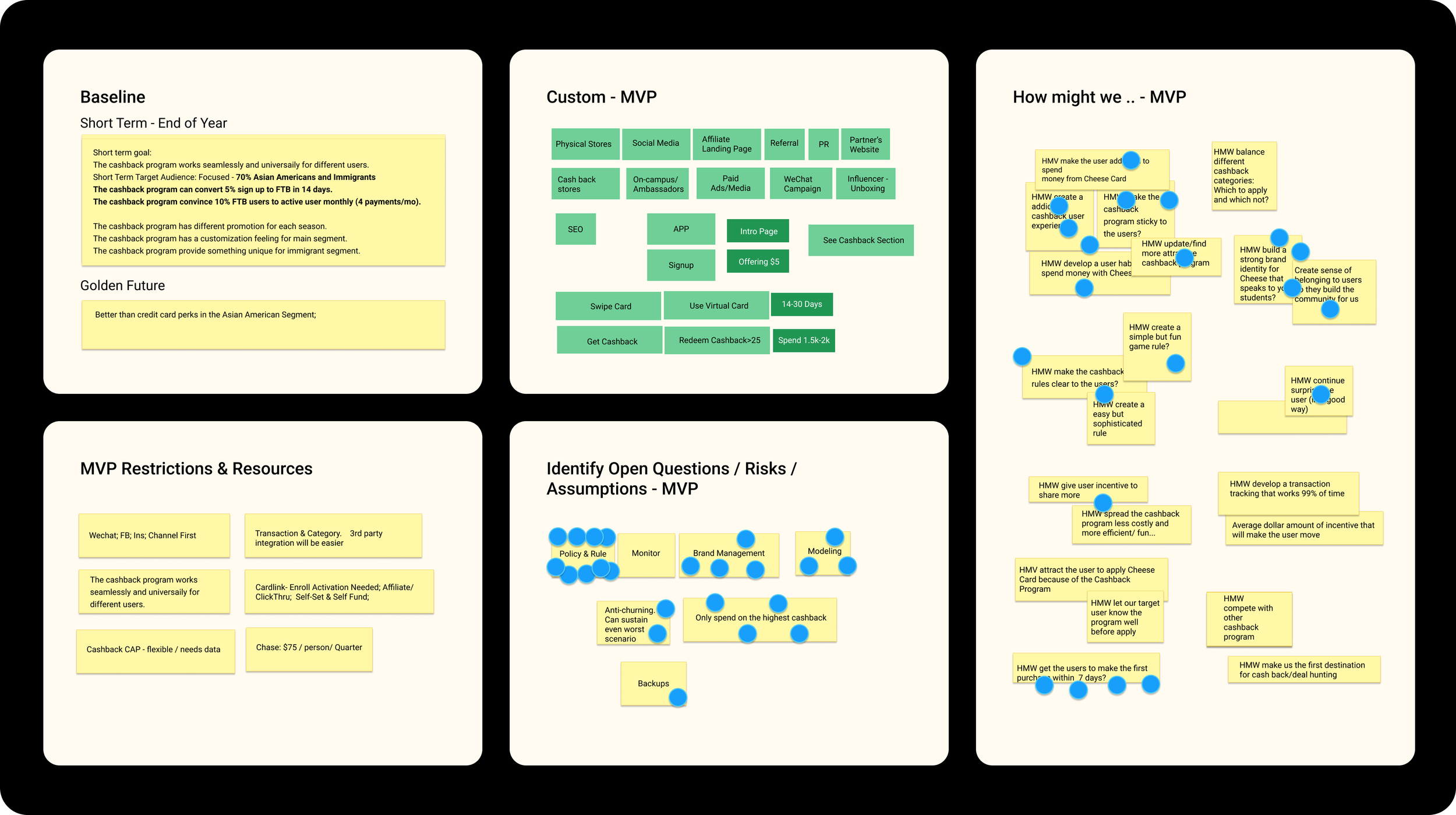

Everyone participated in mapping out the Design Sprint Canvas - to identify business goals, resources, constraints, risk and opportunities.

Short-Term Business Goals

Cheese Mobile Banking has approximately 44,000 users signed up for its debit card. On the first day of the design sprint, CEO and the Product Lead outlined the short-term business objectives: to convert 5% of the signed-up users into first-time buyers (FTBs) and convert 10% of these FTBs into monthly active users (MAUs). An MAU is defined as someone who uses the Cheese debit card to make at least 4 purchases a month.

DESIGN SPRINT DAY 2

Ideation

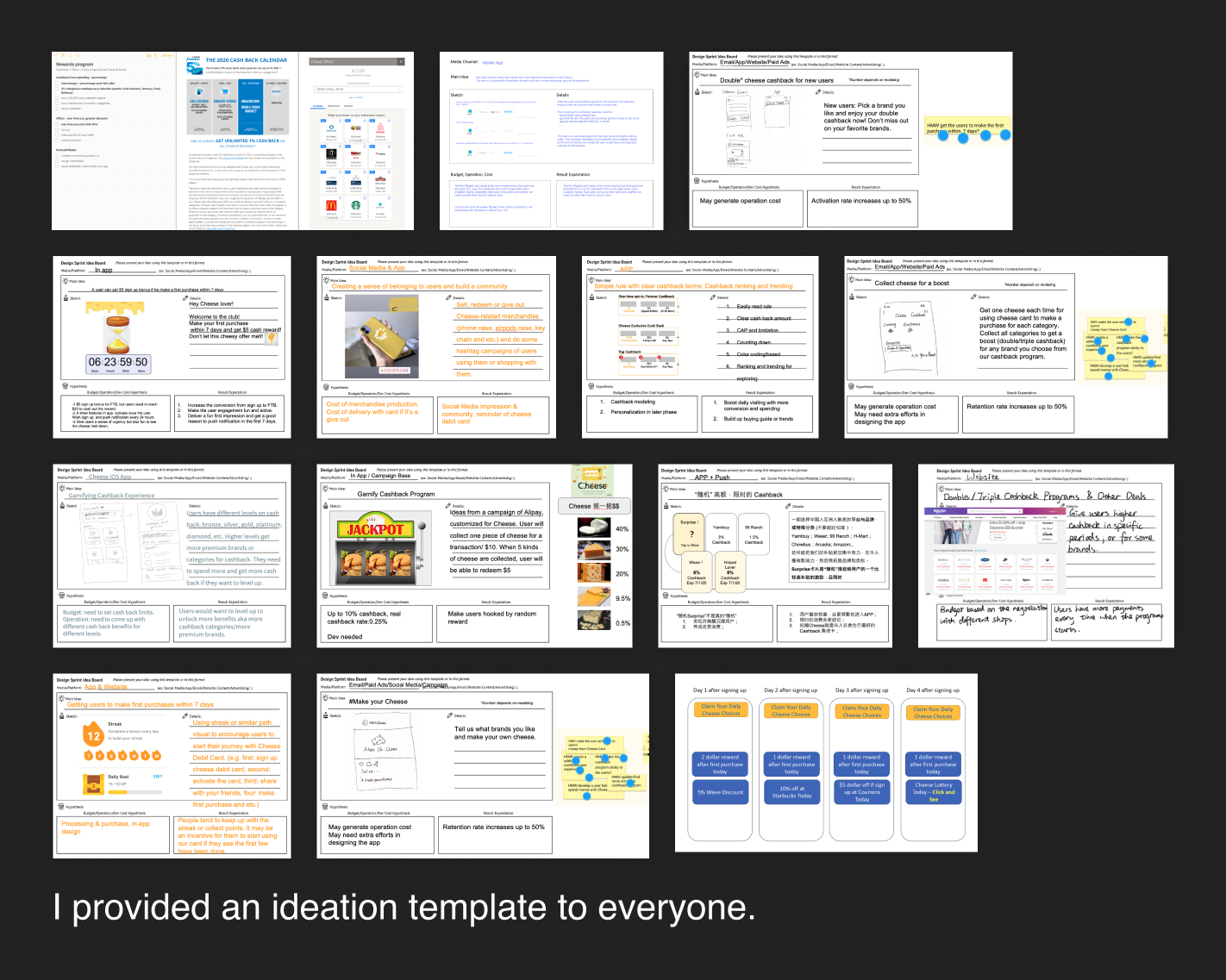

Giving that Cheese has a small team of 14 people, I invited everyone to join the brainstorming process. By providing an ideation template, I enabled team members, including non-designers, to contribute their ideas in writing or by adding screenshot references.

DESIGN SPRINT DAY 3

Demo & Vote

We utilized lightning demos and dot voting to rapidly present and prioritize ideas. Lightning demos involved quick idea presentations by team members, followed by dot voting where each member allocated dots to their favorite concepts. This streamlined process efficiently identified promising ideas for further refinement.

Product Rewards Strategies ––– Defined by Dot Voting

Unlock surprise rewards (10-15% cashback)

Convert signed-up users to first-time buyers (FTBs)

Users complete a task in a limited time to get rewards

Convert signed-up users to FTBs

Maintain a streak in a month to get rewards

Convert FTBs to monthly active users (MAUs)

My design primarily focused on user conversions, as reflected in the first two ideas; while another designer focused on user retention, which is addressed in the last idea.

Empower signup users to earn the surprise cashback and become first-time buyers (FTBs).

MY DESIGN GOALS

Make the cashback experience joyful and engaging.

DESIGN SPRINT DAY 4

Design & Prototype

Mapping out the user flow. Surprise cash back is user’s first touchpoint of the cash back experience.

Home – Before Version

Cash back section sits on home screen right below “My Account”. On the left is the original design without the surprise cash back.

Optimizing for design consistency

Optimizing for discoverability

Optimizing for distinctions among brands

Optimizing for discoverability and delight

Quick Iterations

I made an interactive prototype for user testing.

The Surprise Factor

Unexpected rewards can enhance user delight and engagement, making the cashback experience more memorable and enjoyable. When a product offers more than what was expected, it can increase the perceived value. This can boost user satisfaction.

A Sense of Urgency

Setting a time limit creates a sense of urgency, motivating users to act quickly to get rewards. This can lead to higher overall engagement rates and user satisfaction. The more frequent users use the Cheese card, the more cashback they receive.

DESIGN SPRINT DAY 5

User Testing

Final Design

Show Popular Brands First

Final design shows more popular brands first in the cash back section according to user feedback.

Prompt Users to Take Actions

“Tap to reveal brand” feature nudges users to take action. Additionally, the high-percentage surprise cashback distinguishes this card from other cashback options.

Reveal Popular Brand

Offering a 15% cashback on a popular brand that many people frequently shop from enhances the perceived value of the offer.

Urgency

Displaying an offer with an expiration date encourages users to link a bank account and make a purchase, effectively converting sign-up users into first-time buyers.